Build a Stronger Credit Profile

Discounted Aged Tradelines

Strengthen Your Credit Profile with Established Credit Histories.

Experience Faster Approvals, Better Rates, and Enhanced Financial Opportunities.

pricing

For Quick Credit Boost

Basic Package

Ideal for quick credit improvements with affordable and effective tradelines.

$ 497

What’s included

Tradeline Age: 1 - 3 Years

Credit Limit: Up to $5,000

Reporting Time: 2 - 4 Weeks

Ideal For: Fast credit

improvements.

Buy Now

For Better Loan Approvals

Standard Package

Best for boosting credit scores to secure loan approvals and better rates.

$697

What’s included

Tradeline Age: 3 - 7 Years

Credit Limit: $5,000 - $20,000

Reporting Time: 1 - 2 Weeks

Ideal For: Boosting credit score

for loan approvals.

Popular

Buy Now

For Major Financial Goals

Premium Package

Perfect for major financial goals with high-limit tradelines and fast results.

$997

What’s included

Tradeline Age: 7+ Years

Credit Limit: $20,000+

Reporting Time: 1 Week

Ideal For: Mortgages, business

loans, and high-limit credit

cards.

Buy Now

What Are Aged Tradelines?

Aged tradelines strengthen your credit report, enhancing your financial credibility and opportunities.

Top Benefits of Using Tradelines

Discover How Aged Tradelines Can Improve Your Credit Profile and Unlock Financial Opportunities.

Boosts Credit Score Fast

Authorized user tradelines (being added to someone else’s seasoned credit card) can quickly increase your score, sometimes within 30 days. Older accounts with perfect payment history and low utilization have the biggest impact.

Improves Credit History Length

If you have a short credit history, a tradeline with several years of on-time payments can improve your “length of credit history”, a key factor in credit scoring models.

Lowers Credit Utilization

High credit utilization (using too much of your available credit) drags down your score. Adding a tradeline with a high limit and low balance can significantly lower your utilization ratio and improve your credit health.

Adds Positive Payment History

Payment history is 35% of your FICO score. Being added to a tradeline with 100% on-time payments can strengthen this factor, especially if your own history is thin or damaged.

Increases Approval Odds

A stronger credit profile = better chances of approval for: Credit cards, Auto loans, Mortgages, Business funding, Personal loans

Better Interest Rates & Terms

Higher scores from tradelines often mean lower interest rates, higher limits, and better lending terms overall.

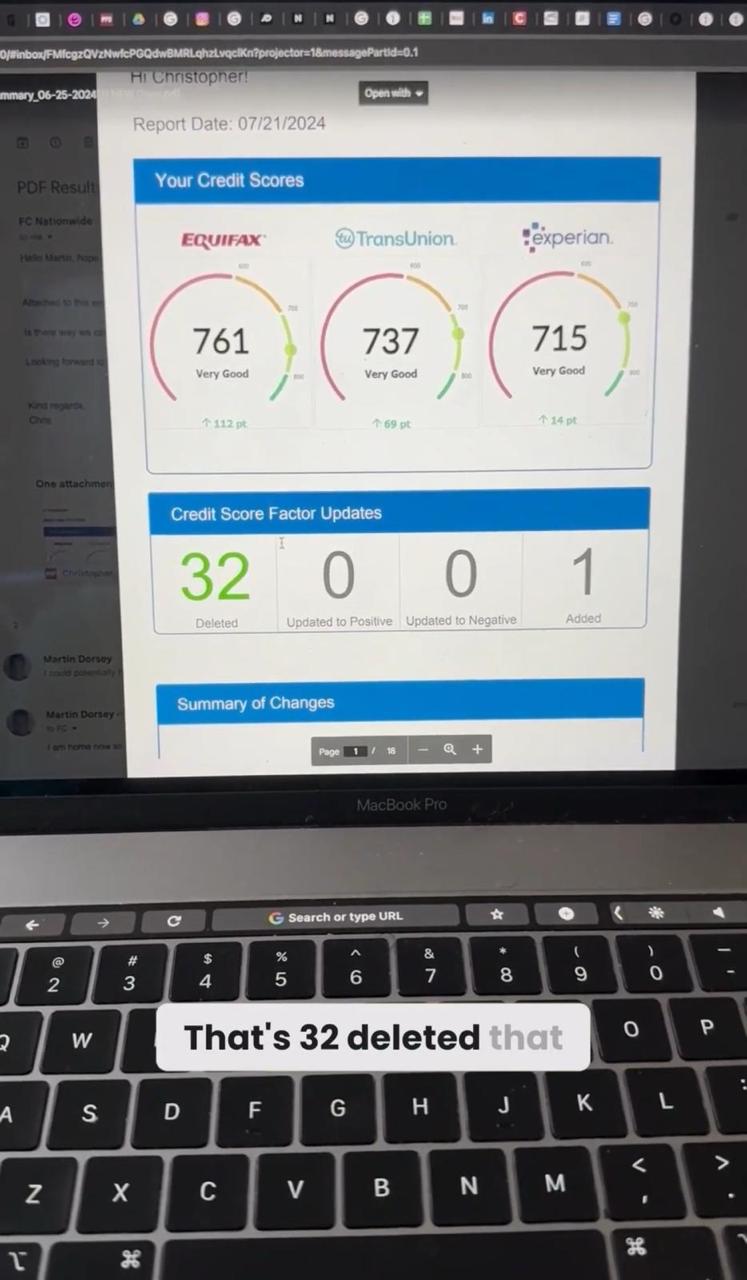

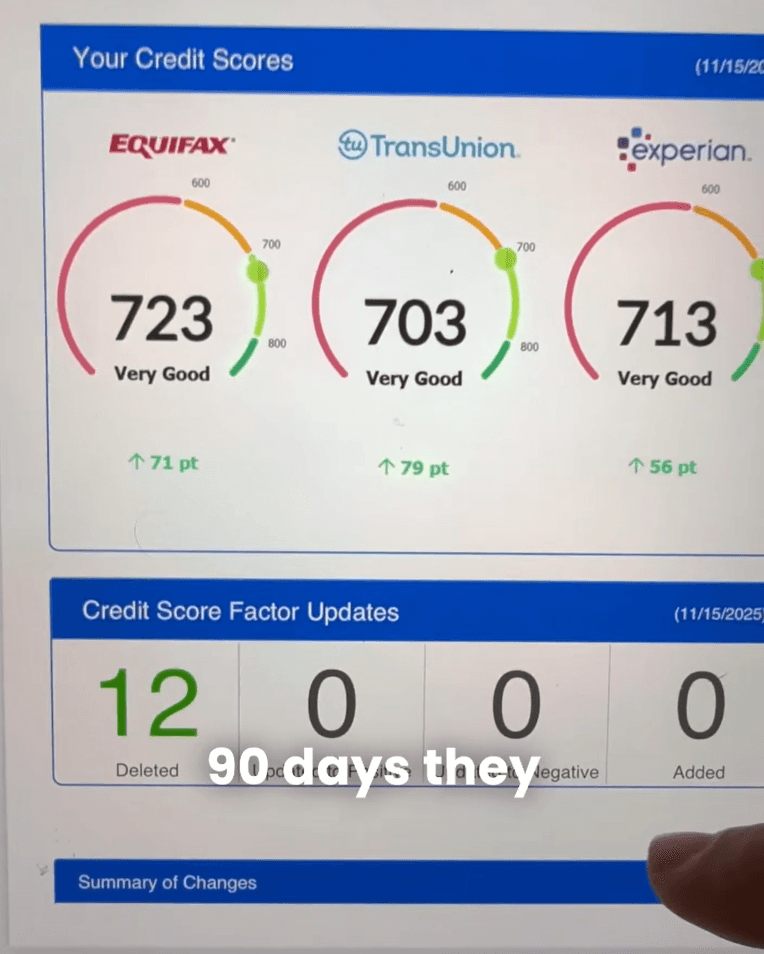

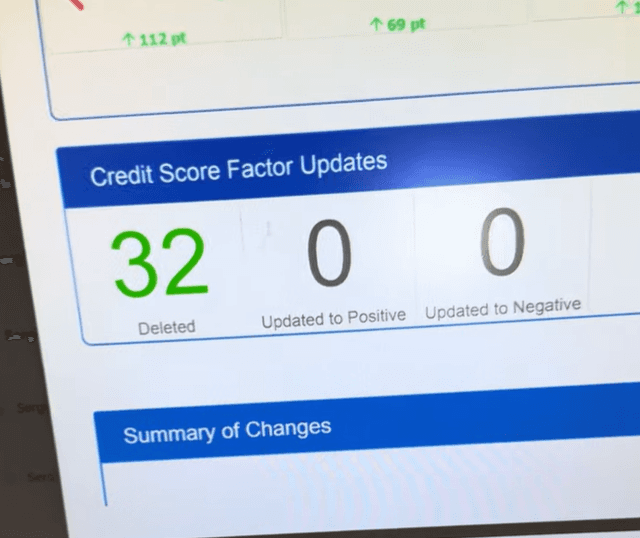

Real Clients, Real Results

Success Stories

Explore real transformations from clients who reached 700+ credit scores within 90 days or less.

Steven describes his experience working with Full Credit Sweep

Justin describes his experience working with Full Credit Sweep

Martin describes his experience working with Full Credit Sweep

Sarah describes her experience working with Full Credit Sweep

Miguel describes his experience working with Full Credit Sweep

Lavina describes her experience working with Full Credit Sweep

Carolina describe su experiencia trabajando con Full Credit Sweep

Michael describes his experience working with Full Credit Sweep

Brittany describes her experience working with Full Credit Sweep

Alan describes his experience working with Full Credit Sweep

Put Your Credit Score Improvement on Autopilot

Experience fast, reliable credit restoration while saving time and stress. Let our experts handle the heavy lifting so you can focus on your financial goals.

Get Started for Free

Copyright © 2026 Full Credit Sweep Inc.