CREDIT TIPS

How to Read a Credit Report: A Step-by-Step Guide

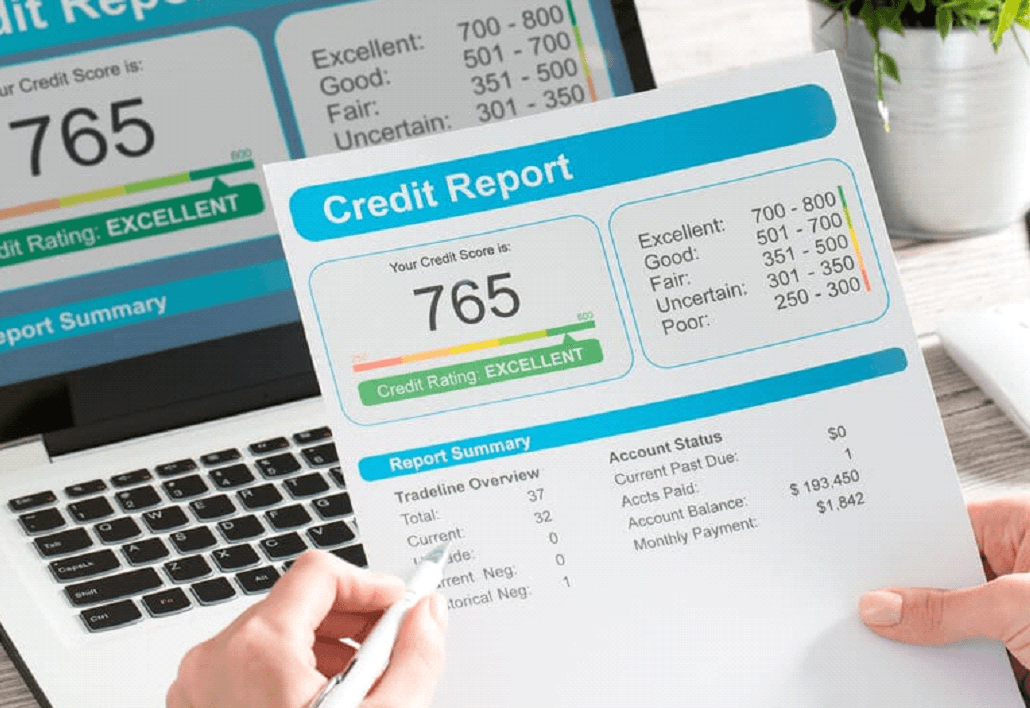

A credit report is a crucial document that details your credit history and financial behavior.

Updated on

Sep 4, 2024

Introduction

A credit report is a crucial document that details your credit history and financial behavior. It is used by lenders, landlords, and even employers to assess your creditworthiness. Understanding how to read a credit report is essential for managing your financial health, spotting errors, and ensuring your credit score accurately reflects your financial habits. This guide will walk you through the components of a credit report, how to interpret the information, and what to do if you find inaccuracies.

What is a Credit Report?

A credit report is a detailed record of your credit history, including information about your credit accounts, payment history, and public records related to your finances. The three major credit bureaus—Equifax, Experian, and TransUnion—compile these reports based on information provided by lenders, creditors, and other financial institutions.

Key Sections of a Credit Report

Your credit report is divided into several sections, each providing different types of information about your financial behavior. Here’s a breakdown of the key sections you’ll find on a credit report:

1. Personal Information

This section includes your personal identifying information. It does not affect your credit score but is essential for ensuring the report belongs to you.

⦁ Name: Variations of your name, including full name, any aliases, or misspellings.

⦁ Social Security Number: The last four digits of your Social Security number.

⦁ Date of Birth: Your date of birth.

⦁ Addresses: Current and previous addresses.

⦁ Employment Information: Your current and past employers.

What to Look For: Ensure all personal information is accurate. Errors in this section could indicate that your credit report is being mixed with someone else's or that you've been a victim of identity theft.

2. Credit Accounts (Trade Lines)

The credit accounts section, also known as trade lines, provides detailed information about your current and past credit accounts.

⦁ Types of Accounts: Credit cards, mortgages, auto loans, student loans, and other credit accounts.

⦁ Lenders/Creditors: The names of the companies that extended the credit.

⦁ Account Numbers: Partial or full account numbers.

⦁ Date Opened: The date when the account was opened.

⦁ Credit Limit/Loan Amount: The maximum credit limit or the original loan amount.

⦁ Balance: The current balance owed on the account.

⦁ Payment History: A record of your payments, indicating whether they were made on time, late, or missed altogether.

⦁ Account Status: Whether the account is open, closed, in good standing, delinquent, or in collections.

What to Look For: Verify that all accounts listed are yours and that the information, such as balances and payment history, is correct. Look for any accounts you don't recognize, which could be a sign of fraud.

3. Credit Inquiries

This section lists companies or entities that have accessed your credit report, categorized as either "hard" or "soft" inquiries.

⦁ Hard Inquiries: These occur when a lender or creditor checks your credit report as part of a credit application process. Hard inquiries can impact your credit score.

⦁ Soft Inquiries: These occur when you check your own credit, or a lender pre-approves you for a credit offer. Soft inquiries do not affect your credit score.

What to Look For: Review the list of hard inquiries to ensure they were authorized by you. Unauthorized hard inquiries can indicate potential identity theft.

4. Public Records

The public records section includes information about bankruptcies, tax liens, and civil judgments, which can negatively affect your credit score.

⦁ Bankruptcies: Types of bankruptcy filed (e.g., Chapter 7, Chapter 13) and the filing date.

⦁ Tax Liens: Unpaid tax debts that the government has filed against you.

⦁ Civil Judgments: Court rulings against you in lawsuits involving financial obligations.

What to Look For: Verify that any public records listed are accurate. Public records should be removed from your credit report after a certain period (e.g., bankruptcies typically remain for seven to ten years).

5. Collections

If you have any debts that have been sent to a collection agency, they will appear in this section.

⦁ Creditor Name: The name of the original creditor or the collection agency.

⦁ Account Number: The account number assigned by the collection agency.

⦁ Balance: The amount owed to the collection agency.

⦁ Date Placed for Collection: The date the debt was sent to collections.

What to Look For: Ensure that the collections accounts are valid and that the balances are correct. Even if you pay off a collection, it may still appear on your report but should be marked as "paid."

How to Interpret Your Credit Report

Once you’ve reviewed each section of your credit report, it’s important to interpret the information in the context of your overall financial health.

1. Understand Your Credit Utilization

Credit utilization is the ratio of your credit card balances to your credit limits. It's a crucial factor in determining your credit score.

⦁ Ideal Credit Utilization: Aim to keep your credit utilization below 30% across all credit cards. For example, if you have a total credit limit of $10,000, try to keep your total balance below $3,000.

How to Use This Information: If your credit utilization is high, consider paying down your balances or requesting a credit limit increase to improve this ratio.

2. Assess Your Payment History

Your payment history is the most significant factor in your credit score. Late payments, especially those more than 30 days overdue, can have a substantial negative impact.

⦁ On-Time Payments: These will be marked as "current" or "paid as agreed."

⦁ Late Payments: Typically marked as "30 days late," "60 days late," or "90+ days late," depending on how overdue the payment was.

How to Use This Information: Ensure all payments are reported accurately. If you see a late payment that is incorrect, dispute it with the credit bureau. Moving forward, always strive to make payments on time.

3. Review Your Credit Mix

Your credit mix refers to the variety of credit accounts you have, such as credit cards, mortgages, and installment loans. A diverse credit mix can positively influence your credit score.

⦁ Types of Credit: Having both revolving credit (credit cards) and installment loans (auto loans, mortgages) shows that you can manage different types of credit responsibly.

How to Use This Information: While you shouldn’t open new accounts just to diversify your credit mix, maintaining a healthy variety of credit can benefit your score.

4. Monitor the Length of Your Credit History

The length of your credit history considers the age of your oldest account, the age of your newest account, and the average age of all your accounts.

⦁ Longer Credit History: A longer credit history is generally better, as it gives lenders more information about your credit behavior.

How to Use This Information: Keep older accounts open, even if you no longer use them regularly, to maintain a longer credit history.

5. Pay Attention to Recent Credit Activity

Recent credit activity, such as new accounts or inquiries, can impact your credit score. Multiple new accounts or inquiries in a short period can be a red flag to lenders.

⦁ Inquiries: Too many hard inquiries in a short time can lower your score.

⦁ New Accounts: Opening several new credit accounts at once can be seen as a risk by lenders.

How to Use This Information: Be selective about applying for new credit, especially if you plan to take out a significant loan (e.g., a mortgage) soon.

What to Do If You Find Errors

If you discover any inaccuracies on your credit report, it’s important to take action immediately. Errors can negatively affect your credit score and potentially lead to higher interest rates or denied credit applications.

1. Identify the Error

Common errors include incorrect personal information, accounts that don’t belong to you, incorrect account statuses, or duplicate accounts.

2. Dispute the Error

You can dispute errors directly with the credit bureau that issued the report. Here’s how:

⦁ Online Dispute: Most credit bureaus offer an online dispute process. Visit the bureau’s website, find the dispute section, and follow the prompts to submit your dispute.

⦁ Dispute by Mail: You can also send a dispute letter to the credit bureau. Include a copy of your credit report with the error highlighted, along with any supporting documentation.

3. Follow Up

The credit bureau typically has 30 days to investigate your dispute. They will contact the creditor in question and ask them to verify the information. After the investigation, the bureau will send you the results.

⦁ Corrected Reports: If the bureau finds an error, they will correct your report and send you an updated version.

⦁ Unresolved Disputes: If the dispute is not resolved in your favor, you can add a statement of dispute to your credit report, explaining your side of the issue.

Conclusion

Reading and understanding your credit report is an essential skill for managing your financial health. By familiarizing yourself with the different sections of your report and knowing how to interpret the information, you can ensure that your credit history is accurate and reflects your true financial behavior. Regularly reviewing your credit report can help you catch errors early, protect against identity theft, and maintain a strong credit score, which is vital for accessing credit and achieving your financial goals.