CREDIT TIPS

Financial Habits That Help Maintain a High Credit Score

Maintaining a high credit score is crucial for achieving and maintaining financial health. A strong credit score opens doors to...

Updated on

Sep 4, 2024

Maintaining a high credit score is crucial for achieving and maintaining financial health. A strong credit score opens doors to better interest rates, loan approvals, and financial opportunities. However, maintaining a high credit score requires consistent and disciplined financial habits. In this article, we'll explore key financial practices that can help you maintain an excellent credit score over time.

Understanding Your Credit Score

Before diving into the habits that help maintain a high credit score, it’s important to understand what factors influence your score. The major components of a credit score include:

Payment History (35%): This is the most significant factor in your credit score. It reflects whether you've paid your bills on time. Late payments, collections, and bankruptcies can all negatively impact your score.

Credit Utilization (30%): This measures how much of your available credit you're using. Lower credit utilization ratios are better for your credit score. Ideally, you should aim to use less than 30% of your available credit.

Length of Credit History (15%): The longer your credit history, the better. This factor considers the age of your oldest account, the age of your newest account, and the average age of all your accounts.

New Credit Inquiries (10%): Every time you apply for credit, a hard inquiry is recorded on your credit report, which can temporarily lower your score. Too many inquiries in a short period can be seen as risky by lenders.

Credit Mix (10%): Having a variety of credit types—such as credit cards, installment loans, and mortgages—can positively impact your score, as it shows that you can manage different types of credit responsibly.

Key Financial Habits to Maintain a High Credit Score

Building and maintaining a high credit score requires consistent and mindful financial habits. Here are the most effective strategies:

1. Pay Your Bills on Time, Every Time

Your payment history is the most influential factor in your credit score. Late payments can significantly harm your score, so it’s essential to pay all your bills on time. This includes not just credit card payments, but also utilities, rent, and other financial obligations.

Tips for Timely Payments:

Set Up Automatic Payments: Automate your payments to ensure that you never miss a due date. This can be done through your bank or directly with your creditors.

Use Payment Reminders: If you prefer to handle payments manually, set up reminders through your phone or email.

Prioritize Essential Payments: If money is tight, focus on paying at least the minimum amount due on your credit accounts to avoid late fees and penalties.

2. Keep Your Credit Utilization Low

Credit utilization refers to the percentage of your total available credit that you’re using. Keeping this ratio low is crucial for maintaining a high credit score. Aim to keep your credit utilization below 30%, but for the best results, try to keep it below 10%.

Ways to Manage Credit Utilization:

Pay Down Balances Early: If possible, pay off your credit card balances before the statement closing date to reduce the reported balance.

Request a Credit Limit Increase: Increasing your credit limit can lower your credit utilization ratio, but only if you don’t increase your spending.

Distribute Debt Across Multiple Cards: If you have multiple credit cards, spreading out your balances can help keep your utilization low on each card.

3. Maintain Long-Term Credit Relationships

The length of your credit history accounts for 15% of your credit score. Lenders like to see that you have a history of managing credit responsibly over a long period. Keeping your oldest accounts open and active can help improve your score.

Tips for a Healthy Credit History:

Avoid Closing Old Accounts: Even if you no longer use a credit card, keeping the account open can benefit your credit history length.

Use Dormant Cards Occasionally: To prevent issuers from closing unused accounts, make small purchases on dormant cards and pay them off immediately.

Be Patient: Building a long credit history takes time. Avoid opening too many new accounts at once, as this can shorten your average account age.

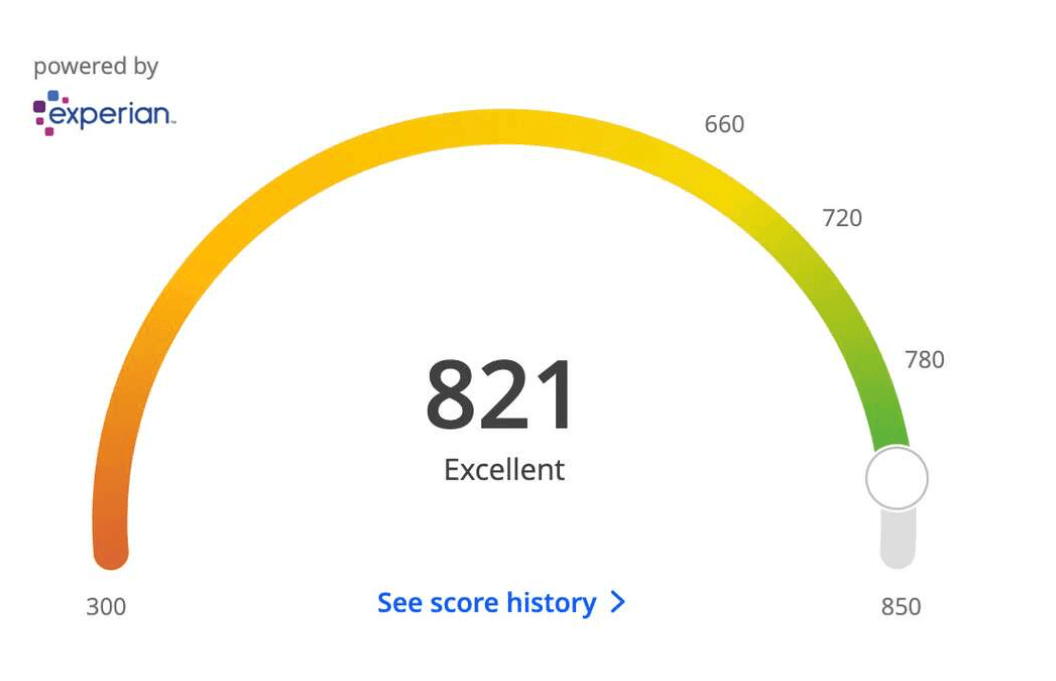

4. Monitor Your Credit Regularly

Regularly reviewing your credit report can help you spot errors, detect fraud, and stay on top of your financial health. Mistakes on your credit report, such as incorrect account information or fraudulent accounts, can harm your credit score.

Steps for Effective Credit Monitoring:

Check Your Credit Report Annually: You’re entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year through AnnualCreditReport.com.

Consider Credit Monitoring Services: Some services offer real-time alerts about changes to your credit report, which can be helpful for staying on top of your credit health.

Dispute Inaccuracies: If you find an error on your credit report, dispute it with the credit bureau and the creditor involved. Correcting inaccuracies can quickly improve your credit score.

5. Limit New Credit Applications

Each time you apply for credit, a hard inquiry is added to your credit report. While one or two inquiries won’t have a major impact, multiple inquiries within a short period can lower your score and suggest to lenders that you are a higher risk.

Strategies to Minimize Credit Inquiries:

Be Selective with Applications: Only apply for credit when you really need it, and research your approval odds beforehand to avoid unnecessary hard inquiries.

Consider Rate Shopping Carefully: If you’re shopping around for a mortgage or auto loan, multiple inquiries within a short period (usually 14-45 days) are often treated as a single inquiry by credit scoring models.

Use Pre-Approval Offers: Some credit card issuers and lenders offer pre-approval or pre-qualification, which doesn’t affect your credit score and gives you an idea of whether you’ll be approved.

6. Diversify Your Credit Mix

Having a mix of credit types, such as revolving credit (credit cards) and installment loans (car loans, mortgages), can positively impact your credit score. This shows lenders that you can manage different types of credit responsibly.

Balancing Your Credit Mix:

Don’t Take on Unnecessary Debt: While it’s beneficial to have a diverse credit portfolio, don’t take out loans or credit cards that you don’t need.

Focus on Responsibly Managing Current Accounts: Demonstrating good management of your existing credit accounts is more important than having a specific mix of credit types.

7. Address Debt Quickly and Strategically

Managing debt effectively is key to maintaining a high credit score. Large amounts of unpaid debt can lower your score and make it more difficult to secure future credit.

Effective Debt Management Tips:

Prioritize High-Interest Debt: Focus on paying down high-interest credit card debt first, as this will save you money and reduce your overall debt load faster.

Consider the Snowball or Avalanche Method: These popular debt repayment strategies can help you pay off your debt more efficiently. The snowball method focuses on paying off the smallest debts first, while the avalanche method targets debts with the highest interest rates.

Avoid Accumulating New Debt: Try to limit new borrowing while you’re focused on paying off existing debt. This will help you keep your credit utilization low and your debt manageable.

8. Build an Emergency Fund

Having an emergency fund can prevent you from falling behind on payments during unexpected financial challenges, such as job loss or medical expenses. An emergency fund acts as a financial safety net, ensuring you can maintain your credit obligations even in tough times.

How to Build an Emergency Fund:

Start Small and Build Gradually: Aim to save at least three to six months’ worth of living expenses. Begin by setting aside a small portion of your income each month.

Automate Your Savings: Set up automatic transfers to your savings account to make contributing to your emergency fund easier.

Prioritize Consistency: Regular contributions, even if small, will add up over time and provide the security you need to protect your credit score.

Long-Term Benefits of Maintaining a High Credit Score

Maintaining a high credit score provides numerous long-term financial benefits:

1. Lower Interest Rates:

High credit scores typically qualify you for lower interest rates on loans and credit cards, saving you money over time.

2. Better Loan Terms:

A strong credit score can lead to more favorable loan terms, such as lower fees, higher borrowing limits, and more flexible repayment options.

3. Increased Financial Security:

With a high credit score, you’re more likely to be approved for credit when you need it, giving you greater financial flexibility and security.

4. Access to Premium Credit Cards:

Many premium credit cards with rewards and perks require excellent credit. Maintaining a high credit score can help you qualify for these offers.

5. Enhanced Employment and Rental Opportunities:

Some employers and landlords check credit scores as part of their application process. A high credit score can improve your chances of getting a job or securing a rental property.

Conclusion

Maintaining a high credit score requires discipline, consistency, and a proactive approach to managing your finances. By adopting the financial habits outlined in this article—such as paying bills on time, keeping credit utilization low, and monitoring your credit regularly—you can protect and enhance your credit score. A high credit score opens doors to better financial opportunities and ensures long-term financial stability, making it a goal worth striving for.